CDC (care for dependent children) from Mdhhs

One of the most helpful forms of financial assistance available to working foster parents is CDC (Care for Dependent Children) childcare assistance. This assistance is provided by MDHHS directly to the childcare provider or the foster families. Foster families seeking this benefit must apply directly to MDHHS and work directly with MDHHS to address any questions or resolve any issues with any part of the process. Neither licensing workers nor caseworkers from private agencies (including Fostering Futures) can offer any assistance with the application or approval process.

Support from MDHHS

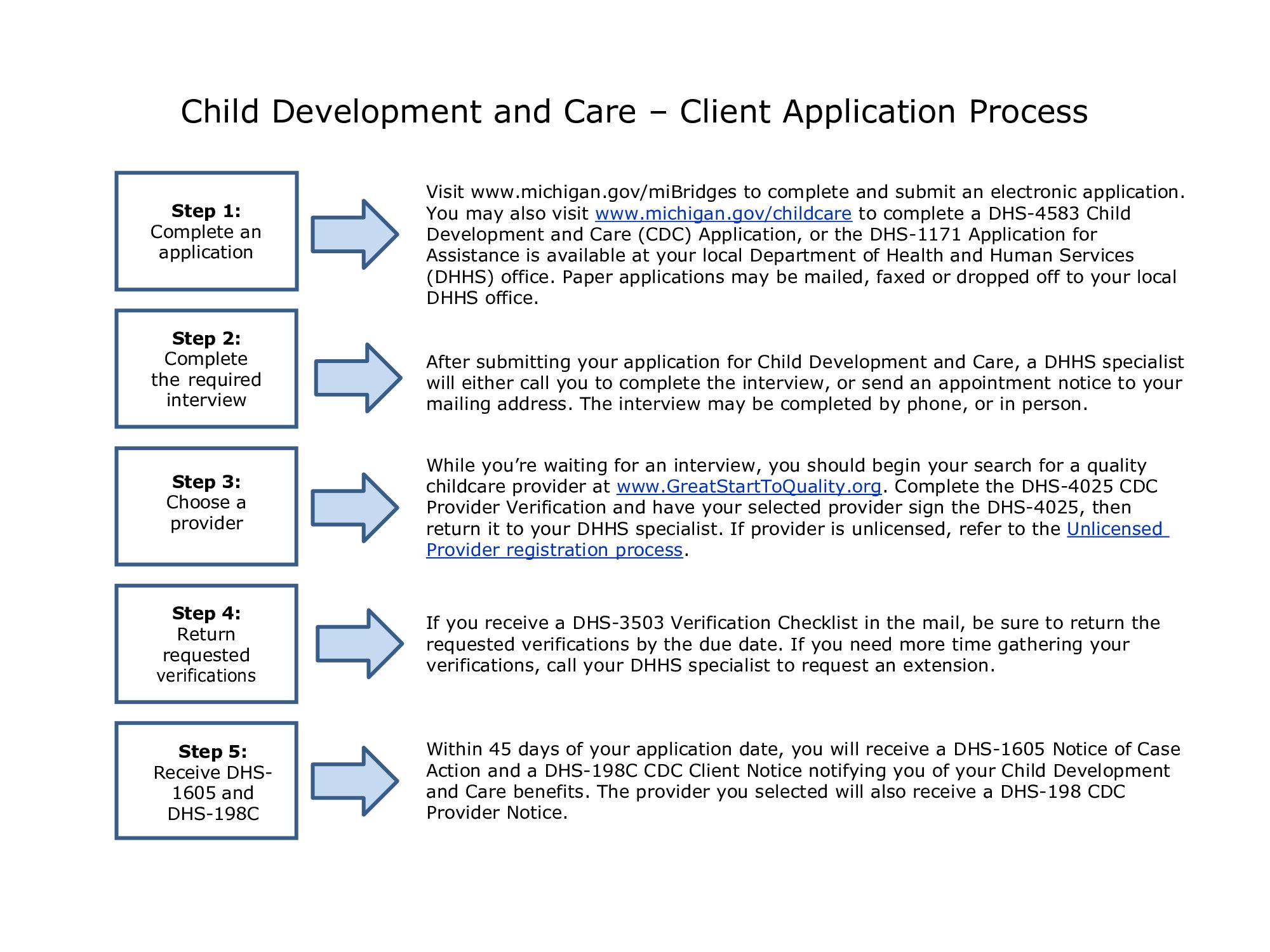

To assist caregivers in applying for CDC benefits, MDHHS has provided the chart below, which outlines the application process. If you are applying for other programs or for children who are not in foster care, contact your local MDHHS office for assistance in applying for these additional benefits.

ADVICE from FELLOW FOSTER PARENTS

Unfortunately, Fostering Futures staff can not help you with applying for CDC beyond what is presented on this page... Families must contact MDHHS directly with any questions about the application process, the approval process, delays in getting approved, etc. You should carefully read the MDHHS CDC documentation, application, and instructions for details on exactly how to apply, what is covered, and how to follow-up on an open application. However, we have gathered some advice and information from our foster families, for the purpose of helping other families as much as possible. Following are some tips our foster families would like to share about their experience with applying for CDC from MDHHS, and other childcare related benefits:

CDC generally helps with traditional licensed day care and preschool programs, before and after school (latchkey) programs, and some summer day camp programs.

Regardless of income, licensed (non-relative) foster parents who work and/or attend school full time automatically qualify for 100% of the CDC hourly rate for the FOSTER children in their care. Note that for couples, BOTH co-parents must work and/or attend school full time to automatically qualify. Full or partial coverage for adopted or biological children is based on financial need, as is coverage for foster children if all parents in the family are not occupied full time with a combination of work and school. Licensed relative caregivers will not automatically qualify for the full CDC rate; their income will be considered.

Even at 100% of the pre-approved hourly rate, CDC assistance may be less than the rate charged by your childcare provider. If so, you are responsible for paying the difference. Generally, the childcare provider will bill MDHHS directly for the pre-approved hourly rate, and bill the foster family for any remaining balance.

BE SURE TO APPLY ASAP! As soon as a child is placed in your home, even before you enroll them in a childcare program, you can begin your application process. While it can take some time for DHHS to process your CDC application, most families tell us that once it finally is processed, coverage will be retroactive to the DATE YOU APPLY (meaning, the date your completed application is submitted online at Michigan Bridges, or when your paper application is received by the DHHS office). If your foster child starts childcare, then you later apply for CDC, they may NOT cover the days the child was in care prior to your application. For this reason, you may wish to consider applying online, rather than mailing in an application, as the benefits begin based on the date MDHHS receives your application.

Families may be able to utilize a Flexible Spending Program offered by their employer to pay for any childcare costs that remain after CDC is applied. These flex programs allow you to pay your childcare balance with pre-tax income. While your company may have a specific annual enrollment period for joining their Flexible Spending Program, the placement of a foster child in your home is a "qualifying event" that should allow you to sign up outside of the annual enrollment period. Important: this usually must be done within 30 or 60 days of placement. Likewise, you should be able to dis-enroll any child from your employer's flexible spending program immediately, if the child leaves your care outside of the company's enrollment period (a child leaving your care is another "qualifying event.") Consult your company's Human Resources Department for details on any such programs that may be available to you.

If you do not use a flexible spending program to pay your childcare balance with pre-tax money, you may be able to claim your out-of-pocket childcare expenses as a deduction or credit on your income tax return. Save your receipts, and consult your tax preparation expert for more information.

IF YOU HAVE ANY HELPFUL TIPS, CONTACT INFO, INSTRUCTIONS, CORRECTIONS, OR ANYTHING YOU WOULD LIKE TO SHARE WITH FOSTER FAMILIES ABOUT CDC FROM MDHHS, please contact Tammy to add it to this page. Call 734-481-8999 or email ttalvitie@ffkids.org.